This is a guest post offering information to small businesses with excessive debt.

This is a guest post offering information to small businesses with excessive debt.

Do you own a small business organization that is desperately struggling to keep up with high interest debts?

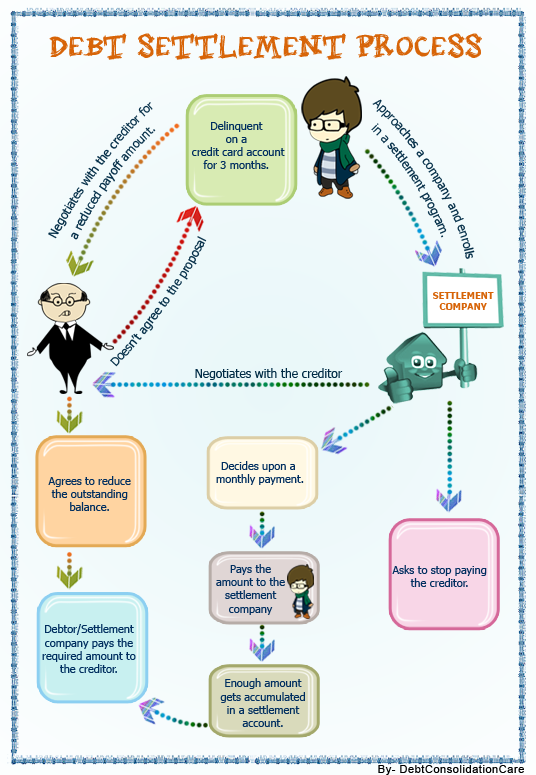

With the present financial situation within the US, this is a pretty normal situation and you need not fret over it. If you’re being threatened by your vendors and suppliers who are threatening you day and night to sue you if you don’t repay them, you’re perhaps the best candidate for a small business debt settlement. Debt settlement is a very simple process where a professional company negotiates with your lenders on your behalf and waives off a portion of your outstanding balance to alleviate your stress of making huge monthly payments. Read on to know more about this entire process and see the infographic:

What is small business debt settlement?

When you’ve been in high interest debt and you’ve felt that filing bankruptcy is the best option for you, you could opt for debt settlement instead. Just as you can settle your personal debts, you can settle your business debts. Either you negotiate with your creditors, tell them about your financial hardship, and agree on an amount that is beneficial for both the creditor and the business owner, or you ask a professional debt settlement company to work on your behalf. It is most likely that your creditors will settle for less money knowing they would receive even less later if you file bankruptcy. There are various companies that excel in providing you with business debt settlement help and avail yourself of this attractive option.

Can the small businesses reap any benefit by going for a debt settlement process?

Debt settlement is perhaps one of the best strategies that a small business can adopt to exterminate their debt issues. As they don’t have a huge amount of cash as revenue, they can be specially benefited when a portion of their balance is waived off. Have a look at the 2 most common benefits of debt settlement:

1. Repay debts within a small period of time: The biggest benefit of the small business debt settlement is that the small business organization can become debt free within a shorter span of time. Though this will certainly depend on the amount that you owe as your business debt, it will certainly take less time than what it could take to pay off your debts on your own.

2. Waived off balance: Apart from getting rid of debt within a short span of time, you, as a business owner can certainly benefit as a large portion of your outstanding balance will be forgiven by your creditors upon effective negotiation. You then repay an amount that is much less than what you actually owed them.

When a small business organization has too much debt, debt settlement is certainly a good option for eliminating your debt burden and improving your financial situation. Just be sure you look for a trustworthy company that will not deceive you and make your financial condition even worse.